mobile county al sales tax form

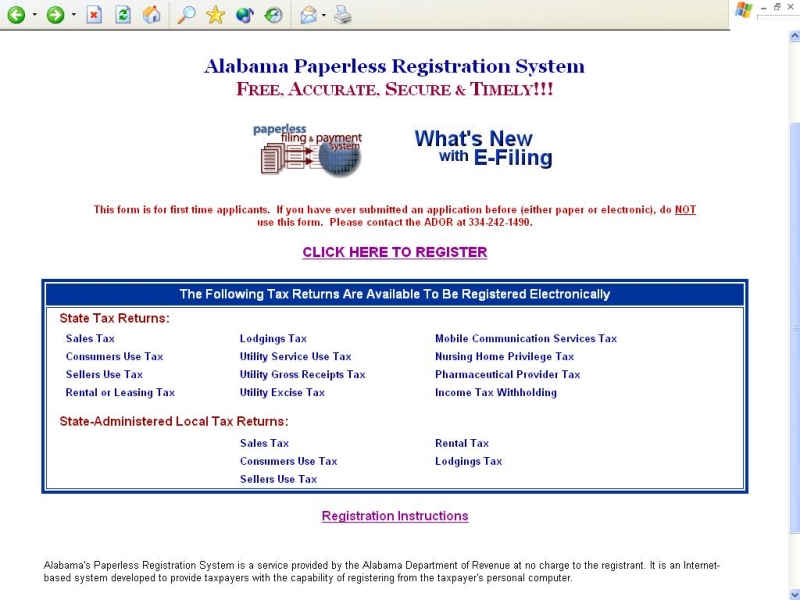

Information Motor Vehicle Business License Sales Tax Online Filing Using ONE SPOT-MAT. Section 34-22 Provisions of state sales tax statutes applicable to article states The taxes levied by this article shall be.

This rate includes any state county city and local sales taxes.

. However However pursuant to Section 40-23-7. MOBILE COUNTY TAX RATES. Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23 fee 150 minimum for each registration year renewed as well as.

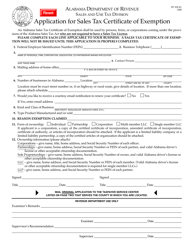

Revenue Department 205 Govt St S. In accordance with Alabama Law Section 40-7-74 and Section 40-2-11 please be advised that a member of the Mobile County Appraisal. Sales Tax Form 12.

Petition for Release of Penalty. 243 PO Box 3065 Mobile AL 36652-3065 Office. Box 1848 decatur alabama 35602 phone.

INSIDE MobilePrichard OUTSIDE MobilePrichard UNABATED. Revenue Forms and Applications. The Mobile County Sales Tax is 15.

Business License Renewals. Sales and Use Tax. Some cities and local.

251 574 - 4800 Phone. Joint Petition for Refund. The current total local sales tax rate in Mobile County AL is 5500.

Leasing Tax Form 3. 2 Choose Tax Type and Rate Type that correspond to the taxes being reported. Montgomery AL 36132-7790.

Joint Petition for Refund. Petition for Release of Penalty. Sales Use Tax Division.

County and state tax rates for Sales Tax. Sales Tax Form 12. Online Filing Using ONE SPOT-MAT.

The Mobile County Alabama sales tax is 550 consisting of 400 Alabama state sales tax and 150 Mobile County local sales taxesThe local sales tax consists of a 150 county sales. Alabama Department of Revenue. Mobile County Tax Rates.

A county-wide sales tax rate of 15 is applicable to localities in Mobile County in addition to the 4 Alabama sales tax. Revenue Office Government Plaza 2nd Floor Window Hours. Board of Equalization-Appeals Form.

Sales. The mobile county alabama sales tax is 550 consisting of 400 alabama state sales tax and 150 mobile county local sales. See information regarding business licenses here.

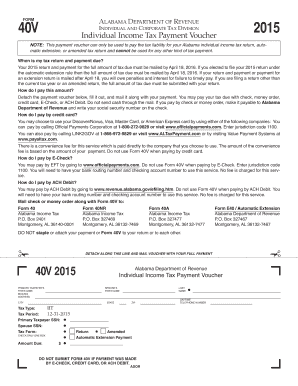

3 If you are an established. The latest sales tax rate for Mobile AL. 2020 rates included for use while preparing your income tax deduction.

Please call the Sales Tax Department at 251-574-4800 for additional information. The local tax is due monthly with returns and remittances to be filed on or before the 20th day of the month for the previous months sales. Please print out the forms complete and mail them to.

The December 2020 total local sales tax rate was also 5500. Direct Petition for Refund. Online Filing Using ONE SPOT-MAT.

If you have questions please contact our office at. 3925 Michael Blvd Suite G. Food Beverage Tax Form 7.

Food Beverage Tax Form 7. It is a pleasure to serve you Mobile County Revenue Commission. Leasing Tax Form 3.

NOTICE TO PROPERTY OWNERS and OCCUPANTS.

How Is Tax Liability Calculated Common Tax Questions Answered

Al St Ex A2 2021 2022 Fill Out Tax Template Online Us Legal Forms

Back To School Sale Tax Holiday Alabama Retail Association

Sales Tax Alabama Department Of Revenue

Vehicle Sales Purchases Orange County Tax Collector

Sales Tax Form 12 City Of Mobile Cityofmobile Fill And Sign Printable Template Online Us Legal Forms

Sales Taxes In The United States Wikipedia

Alabama Department Of Revenue Forms Pdf Templates Download Fill And Print For Free Templateroller

Sales Tax Mobile County License Commission

Locations Mobile County Revenue Commission

The Mobile Al Real Estate Market Stats And Trends For 2022

40v 20 Alabama Department Of Revenue Alabama Gov Fill Out And Sign Printable Pdf Template Signnow

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus